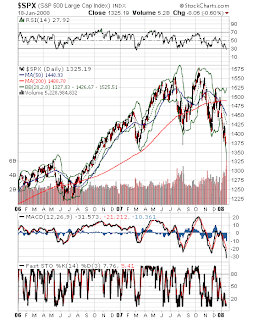

S&P Futures are pointing to a large gap to the downside in response to a vicious selloff in world equities. As I've shown in previous charts, the S&P and other broad US indices are topping out. Now that we've broken the neckline on the S&P's head and shoulders pattern, the S&P will likely trade down to 1250. How did I get that target? Take the distance from the neckline to the top of the head and reflect it downward. Once we reach that level, I might be interested in taking a look at buying. Before then, I'm highly skeptical.

You can't deny that we now have capitulation in stocks. Why? We are down 10% in one month! Also, look at almost any chart. Everything is weak, topping out or falling apart. Furthermore, there are no more safe havens. Everything, including the most defensive companies are getting sold. First money flowed to tech, then to healthcare, then to biotech. But all of those are now failing to attract "safe haven" money.

This pace of selling is not sustainable. Soon, sellers will have overdone everything and priced in a permanent recession. This is already beginning to happen as the good is starting to go out with the bad. We'll just have to wait for a reliable technical signal to occur before looking at anything on the long side. Meanwhile, watch the Fed panic and try and salvage things; KEY WORD = TRY.

No comments:

Post a Comment