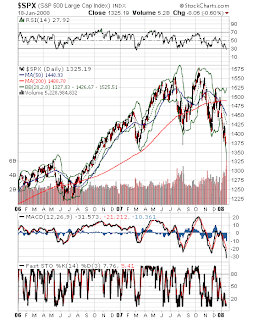

S&P 500 support at 1410ish then 1370 means theres more to go folks. If those levels break, you're looking at 1290 in the not so distant future.

The S&P looks to be in the late stages of forming a head and shoulders pattern. It's a very well defined shape, as you can see above, but a break in the neckline is still needed to confirm this pattern. Also, look at the volume on the S&P. You can see that the declines come with much, much, much heavier volume than the upshots. Buyers are tepid, which could definately be a sign that this is in fact a head and shoulders pattern.

Another negative includes the fact that the 50 sma has now broken through the 200 sma. I've circled this on the chart above.

Also, look at the chart right above of the Nasdaq. Although the S&P and DJIA are exhibiting very similar action, the Nasdaq most clearly illustrates this clear break of support.

It's evident that all the averages broke near term support and should be headed downward from here until the next level of support at 1370ish. I would remain bearish until, that level is hit, bounced off of, or broken.